Value can be seen as the degree of importance, worth or usefulness of a good or service. With this in mind we can therefore say that the value placed on a good or service is subjective to the use and importance of that good/service to that individual.

The common factor we can use to measure value for it to have a standardized meaning is price. Even though our premise in this text says that the price of a good or service determines the value, we can´t completely sideline other facts about value. For instance, water which seem to be very valuable happens to have a very low price. To this end, I will like you to see water as our exception in value measure.

For us to have a better understanding of where we are driving to, I will like us to contextualize value by looking at two financial meanings of Value:

Fair Market Value:

is the price at which an informed, able and willing seller would trade a good or service to an informed, able and willing buyer. For example, the market value of the food you eat from a restaurant, is determined by the price you pay for the food. Same with your job, the market value of the services you offer at your job site is determined by the price your employer pays you.

Intrinsic Value: is the price of a good or services offered by someone who has complete information and understanding of the characteristics of the goods and services in question. For example, if you have the information that a manufacturing company will be opening closer to one of your apartments which you give out for rent, with such an information, you will increase the price of your rents because you now know that there will be an increase in the demand for housing. The same goes for your employees. The more you know that your employee is educated, the more you are willing to pay him/her.

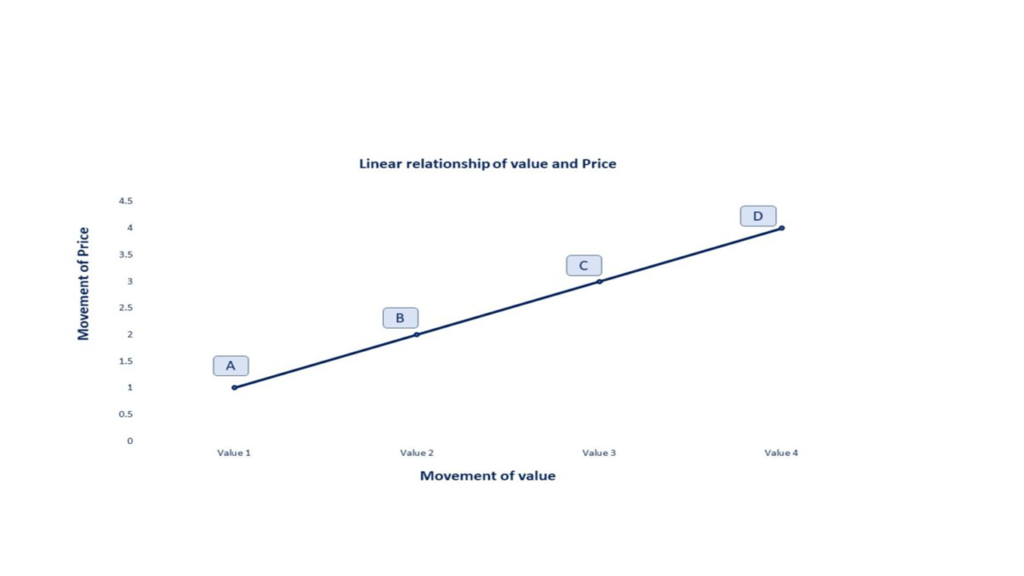

Based on these definitions and for the purpose of a clearer understanding we shall ASSUME That the value of something is a function of its price. That is the price determines the value. Meaning the more value is put on something or someone in the society, the higher the price tag. As shown on the diagram below.

5 STEPS ON HOW TO DETERMINE WHAT YOUR VALUE IS AND WHAT YOU ARE WORTH.

- Know the amount of cashflow you can generate in the future:

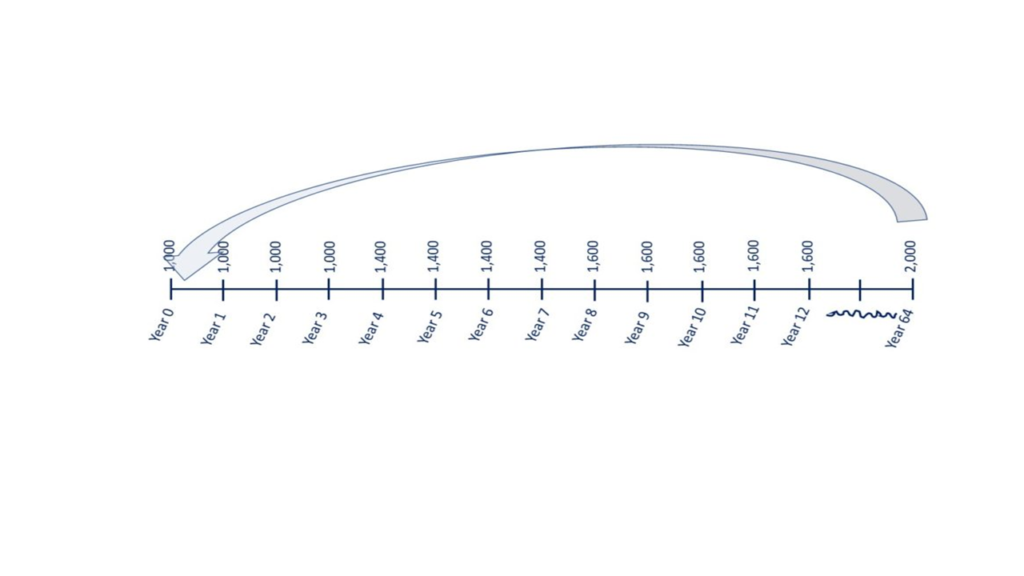

Cashflow refers to the amount of money your employer will pay you in the future or the amount of money you will generate in your business and other certain form of income in the future. E.g. having a steady salary of 5,000 dollars each month.

- Estimate the amount of time in the future you will be generating this cashflow, be it from your job or personal businesses. That is for how long are you going to be working, or for how long are you planning to continue generating income from your business?

- Know the impact of inflation on your future cashflow:

Inflation is that aspect of the economy that makes your purchasing power to drop from time to time. For example, last year you used 10 dollars for a plate of meal and this year the same plate of meal cost you 11 dollars. This means your purchasing power has dropped as you need more money to make the same purchase. At this stage, Make an estimate of how much you will be earning each month, so you can multiply that amount by 12 months to know how much you will be earning each year.

- Assume your pay increase. You have to assume that every after 4 years you will be having a raise in your salary if you are planning to know your long-term value. My advice is to just follow this analysis for 2 years so as not to make the exercise complicated.

Discount all your cashflows that are in the future to get the amount in the present so as to minimize the effect of inflation (purchasing power decline) on your future income. Then divide the amount you get by the number of months you will take to generate that income. The value you will have here is your Intrinsic Value.

- Know if you are being Undervalued, Overvalued or moderately valued:

Since the primary goal of this exercise is to know your value, the value you will have in step 4 will be your intrinsic value. An the intrinsic value should be your true value since you have all the information about yourself that is; you know the amount of degrees you have, you know your work experience and your abilities. So if the market value that your employer is offering to pay you is below your intrinsic value, then you know you are undervalued and you should make a point by politely telling your employer why you think you are worth more than what he or she is offering. The reverse is true.

The whole idea about this exercise is for you to be able to know your value. No matter the situation, be it in your relationship or whatever. You should note that people are willing to pay more for a higher value and less for a lower value.

To know how to earn more, improve your value and increase your income, you should check our blog on how You can Increase Your Value and Grow Your Income.